I can promise you that will not get rich by skipping your daily latte.

Look, if you don't have income, then there is no money to save. Don't let anyone give you the idea that you need to skip your Starbucks coffee and save $5 a day and that will somehow turn into a fortune.

Maybe you can skip spending $5 at Starbucks every day and save $10,000 over the next five years, but if you think $10,000 is going to change your life, you're not just broke, you're being stupid. Of course you should spend less than you earn, but if you make $50,000 a year with a couple of kids, what money is there left over to save?

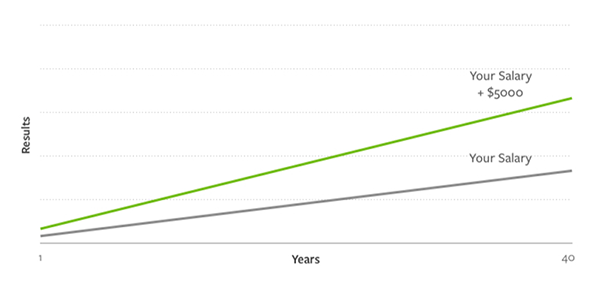

If you are serious about getting rich, you need to get your mind focused on income. Increase your income enough and you will be able to save something substantial.

1. Invest in you

Successful people invest time, energy, and money in improving themselves. A man told me once, "The best way you can help people in need is to not be someone in need." Help yourself out so you are in a position to help someone else out. This means investing in yourself to become great at something.

I invested in sales training when I was 25. That made my income-producing ability skyrocket. Investing in yourself is the best investment you can make.

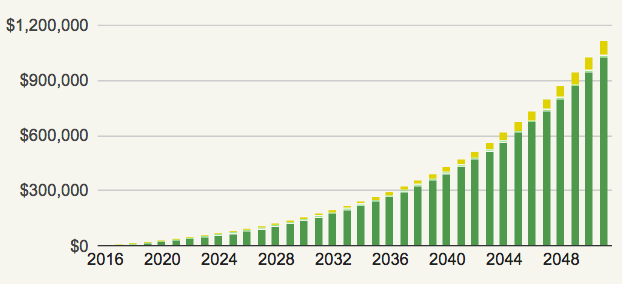

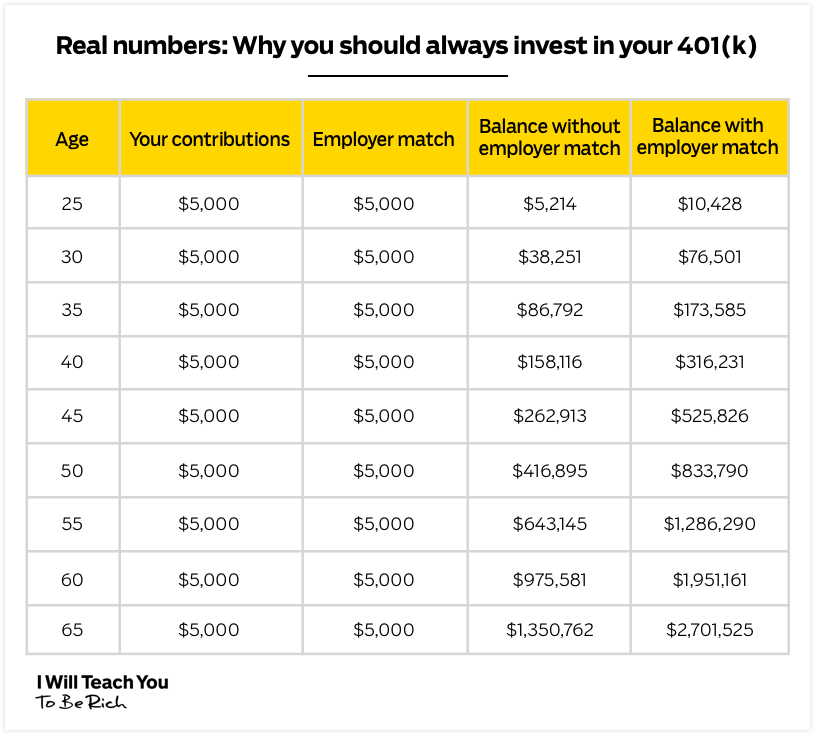

Money begets money – this is what is generally believed. In other words, this means that the more money you have and you invest, the more wealth you will be able to generate. (Reuters)

Money begets money – this is what is generally believed. In other words, this means that the more money you have and you invest, the more wealth you will be able to generate. (Reuters)